|

| Paul Krumm |

The

Monetary Cliff: Its the Driver behind Deficits, the Fiscal Cliff and

Sequestration

Rethinking

our Centralized Fiat Money System

The

fiscal cliff, sequestration and government deficits have been in the

news til we get tired of hearing about them for the last year. But

there has been little or no analysis of the structure and function of

the financial system that is at the root this problem. The following

is an attempt to fill this void.

To

understand why deficits occur, it's first necessary to know something

about the nature of money.

- While the network of money transactions around the world is very complex, the way money works is really fairly simple, and is understandable by the ordinary person.

- Some money systems historically have uses a commodity as the basis of money. Ours does not. Instead. . .

- Our money is simply entries in an accounting system. It is not stuff in the usual sense. Our money is simply numbers that measure who has contributed how much to the market, and who has consumed how much. It has no intrinsic value. We sometimes use paper money and coins, however they are just place holders for entries in the accounting system.(1)

- On another level our money is an agreement to use an accounting system to keep track of economic exchanges. In recognizing that money is an agreement, we are open to look at the nuts and bolts – the rules - of that agreement, to consider if they are what we want to live with, and to consider changes to those rules if changes would make the system serve us better.

- Money is created in the process of making loans, and disappears in the process of repaying those loans. It is created as a negative entry in the account of the buyer when they make a purchase and a positive entry in the account of the seller. It disappears as the negative entry is canceled

- It is trust in other community members keeping their commitments that makes an accounting money system possible and workable.

- The value of money is simply based on the fact that the public accepts it as a medium of trade, and the government accepts it in payment of taxes.

- Since money is the language of economic interchange we can't underestimate the ways in which its rules effect how we think about ourselves as we relate to other people and our environment.

Once

we get our heads wrapped around these basic ideas, it is possible to

begin to understand our money. Additionally

-

We need to stop thinking of ourselves just as consumers. In order to consume it is necessary to also be a producer of goods or services. Combining these two functions, we must instead see ourselves as traders (or dependents on someone who is a trader). The term 'trader' has been taken over by people who trade only financial instruments for their profit without doing any work. In what follows, the term trader will be used to describe traders in the productive market, rather than financial traders.

- Thinking of oneself as a trader gives a different view of one's position in the market. Traders have power in the market both in how they earn money and how they spend it. If small traders get together and cooperate, they can become a major factor in the economy.

Simple

money

In

simple accounting money systems, money is created by the individuals

making trades. Money is created every time a transaction occurs.

This is a zero sum game, and every one's balance revolves around

zero. Generally, neither large positive or negatives balances are

approved. Money created in this way is called mutual money.

As an example, if I buy some thing or service with simple accounting

money, and don't have a sufficient balance in my account, I get a

negative entry equal to the amount I don't have. In doing

that I make a commitment to bring my account back to zero by

providing goods or services to others in my market/trading community.

The seller gets a positive entry in their account, erasing part or

all of any negative balance that they currently have, and/or

increasing their positive balance. As I make sales/receive pay for

work I do, I return my balance to zero, or make it positive. Rather

than having a distinct loaning process, small loans/negative balances

are simply a part of the operation of a balanced system.

The

commitment I make to eliminate my negative balance/debt is called

seigniorage in

Economicspeak. We will learn more about seigniorage later.

Trust and trustworthiness are the glue that makes simple accounting

money work. Traders have to be able to trust that other traders will

keep their commitments. This requires transparency in system

operation. On the community scale where simple accounting money has

been practiced, transparency and community pressure is sufficient to

enforce commitments. In this atmosphere, people expect to, and are

expected to, keep their commitments.

In such a system, if a community sees that there would be a benefit

in investing in a member or group of its members, the community can

give them permission to carry a temporary negative balance to

complete a project or buy a service or product. This has the same

effect as large loans in today's economy, except that the decision of

who will be given this permission is made by the community, rather

than a bank.

Since

money is created and canceled every time a transaction occurs, the

money supply is automatically regulated by the traders in a mutual

money system. We will see later how this is different from the

present situation. Costs of accounting system operation are covered

by transaction fees, by fixed recurring user fees, or by fees based

on account balance. Effects of different schemes for covering the

costs of accounting and administration will be discussed more later.

Our

present money system and its history

Our present system is not quite so simple. In it, the banking system has taken over the money creation process: seigniorage.

Fiat money (aka legal tender) is the Economicspeak term given to this kind of money system. Instead of the trader/borrower being committed directly to the market, they make a commitment to a bank, and traders are required to maintain a positive balance in their bank account, or make a commitment to a bank. Banks are a special kind of trader; the only ones that can create money. Anyone that wants or needs money has to 'borrow' from a bank that creates it out of nothing (ex nihilo in Economicspeak) in return for the bank's temporary ownership of the asset being purchased.(2)

Fiat money (aka legal tender) is the Economicspeak term given to this kind of money system. Instead of the trader/borrower being committed directly to the market, they make a commitment to a bank, and traders are required to maintain a positive balance in their bank account, or make a commitment to a bank. Banks are a special kind of trader; the only ones that can create money. Anyone that wants or needs money has to 'borrow' from a bank that creates it out of nothing (ex nihilo in Economicspeak) in return for the bank's temporary ownership of the asset being purchased.(2)

Our present system is not quite so simple. In it, the banking system has taken over the money creation process: seigniorage.

Fiat money (aka legal tender) is the Economicspeak term given to this kind of money system. Instead of the trader/borrower being committed directly to the market, they make a commitment to a bank, and traders are required to maintain a positive balance in their bank account, or make a commitment to a bank. Banks are a special kind of trader; the only ones that can create money. Anyone that wants or needs money has to 'borrow' from a bank that creates it out of nothing (ex nihilo in Economicspeak) in return for the bank's temporary ownership of the asset being purchased.(2)

Fiat money (aka legal tender) is the Economicspeak term given to this kind of money system. Instead of the trader/borrower being committed directly to the market, they make a commitment to a bank, and traders are required to maintain a positive balance in their bank account, or make a commitment to a bank. Banks are a special kind of trader; the only ones that can create money. Anyone that wants or needs money has to 'borrow' from a bank that creates it out of nothing (ex nihilo in Economicspeak) in return for the bank's temporary ownership of the asset being purchased.(2) Because the banker is not the one committed to making the payments to repay the loan, seigniorage in this case becomes, in David Korten's terms, phantom wealth.(3) Phantom wealth is a claim against real wealth for which nothing was produced. As a result of this set of money rules, the banking system controls to whom, and for what, money is created. The system is enforced by the bank's control of assets pledged.

A primary implication of this structure is that money is created, and the economy is therefore driven by the profit motive of the banking community, especially the central bankers. The banking business is, after all, a for profit business. Money is only created if it has a high probability of profit for the banks, and the greater the profit, the better. Operating within this structure, the only products or services that get through the gate of financing, and are also in the interest of the users of money, are those that provide profit for the banking industry. The welfare of money's users, and the health of the ecosystems on which we depend are not a priority. The result is documented in Sleepwalking to Extinction.(4) This is in contrast to the simple money system described above in which the driver of money creation is the needs of individual traders, and their community.

|

| Quentin Matsys, The money changer and his wife, 1514 |

Our banking system is a hold over from the late Middle Ages

when money was based on the value of precious metals, gold and

silver. The bankers of the time - the goldsmiths - stored excess

gold and silver coins and raw metal for their customers, as well as

for themselves, as they had secure vaults. It was found by traders

that it was easier to keep and trade the certificates given out by

the goldsmiths, rather than taking out the metal when a trade was

made, so the certificates came to be used as money. The goldsmiths

also loaned certificates representing their gold and silver stocks,

instead of coins, when traders wanted loans. They charged interest

on these loans.

Then,

when there was insufficient gold and silver to operate the burgeoning

economy the enterprising goldsmiths realized that they could loan out

more certificates than they held in gold and silver, creating

seigniorage. This worked quite well as long as not everyone wanted

to retrieve their gold and silver at the same time, and resulted in

the goldsmiths becoming quite rich and powerful, creating money by

loaning receipts at interest for precious metals that didn't exist.

The work they did to manage these loans was not commensurate with

their profits, so they gained phantom wealth as a result. A problem

was that there were times when confidence in the goldsmith/bankers

was questioned, there were runs on banks, and when the goldsmiths

didn't have sufficient gold to back up claims for more metals than

they had, banks failed and people lost their money.

This

was the origin of our present banking system.(5) The system was made

more legitimate when King George I of England, who wanted to start a

war, and had insufficient funds, borrowed from the bankers, and made

the system legitimate for paying taxes. With this act, the tally

stick money that had served England previously,(6) was replaced by

loans from the banks, replacing seigniorage on the part of the crown

to seigniorage on the part of the bankers. Money continued in the

same way until the presidency of Richard Nixon, with accounting

entries far outpacing the precious metals backing the currency.

During the Nixon administration the connection between the price of

gold and silver, and the dollar, was totally eliminated, completing

the conversion of our money exclusively to accounting entries.

As

you can see from the above description, in this system, the bankers

manage the money supply, rather than the users. Their primary

motivation in management is of course to maximize their profit. This

is in contrast to the simple money system described above, where the

needs of traders are the motivation for creating money.

How

Fiat money is created

As

noted above, Fiat money is created in the loan process. It works as

follows. If I want to buy a car, for instance, I go to the bank for

a loan. The bank takes temporary title to the car, and based on its

value, creates an entry in my account which I use to pay for the car.

As I pay off the loan, the money is canceled and when payment is

completed, I get clear title to to the car.

However

the practice of charging interest still persists. Those who owned

gold insisted that the privilege of having the use of their gold had

a time value, and interest was charged as an indicator of that value.

However now that money is simply accounting information, that

argument is no longer valid. While a portion of interest is

necessary to pay the costs of accounting and administration, interest

is not a good measure of these costs. Again, more on this later.

The casino and the monetary

cliff

|

| courtesy of Colin Anderson and secondretirements.com |

The best way that I have found to characterize the present

money system is by using the metaphor of a casino. In a casino, we

have three main groups of players. First is the house, the owner of

the casino. Second is a group of contract table operators and one

armed bandits, which are the interface with the public. The public

is the third group. In our money system, the 'too big to fail' banks

and bankers are the house, local banks and ATMs are contract table

operators and one armed bandits respectively, and traders are the

users of the casino. However going to this casino is mandatory,

instead of optional, if one is to pay taxes or make trades in the

economy.

Interest

is the mechanism that provides the profit for the money casino.

Seigniorage is the lever that enforces the system.

Local

bankers, the contract table operators in the casino metaphor, have to

deposit reserves with the central bank, the Federal Reserve - also

known as the Fed - to the tune of 5-10 % of the money that they

create. This High Powered Money is in turn created by the Fed out of

nothing. In this way, the central bankers, the house, who hold a

controlling interest in the Fed, get a cut on all loans made by local

banks, in addition to the direct interest income from large loans

that they make to the government and large corporations and smaller

loans they make to traders who deal at their branches.

When

interest is created as a part of a loan, it is treated differently

than the principal. Interest is created only as a debt to the bank

making the loan. It is not created as new money. So

interest has to be paid out of money already in circulation. If

there is no growth, not enough money is available for the use of the

Main Street trading community to pay both principal and interest when

they both come due, as more money is owed to the

banking industry than was created.

This

set of accounting rules with central control, interest, and a for

profit money creation industry, leads to a number of structural

issues, some very practical in terms of monetary stability, and

others more of a moral nature. These results of system operation

will help us understand why we are approaching the monetary cliff.

Practical

issues with interest bearing money

Because

interest isn't created as new money, to pay it as time goes on, one

or more of the following three things has to happen.

- The economy has to grow continuously at an exponential rate so that there is sufficient money too pay all of the interest due to the money creation industry,

- The money has to get worth less so that more money is traded for the same amount of goods and services (which we call inflation or an economic bubble), or

- A number of traders on Main Street have to go bankrupt, ceding their assets to the banking sector.

Following

is a discussion of some of the ramifications of this conundrum.

Exponential

growth

|

| compound interest |

In the simple money system described earlier, growth occurs when it

is appropriate for the economy, but it is not necessary for stable

money system operation. The money supply increases and decreases

with the needs of its users. For the present system to operate in a

stable manner, the money supply must continually grow at an

exponential rate. If growth doesn't occur, inflation or bankruptcies

are the result.

One

of the results of this need for growth is that increasingly over

time, more resources, both human and natural, have to be used for

collateral for loans by turning them into commodities and monetizing

them (by borrowing against their value) to keep the monetary system

operational. This is the connection between the operation of our

money system and environmental degradation as well as disparities in

wealth.

It

must be understood that the real reason behind why mainline

Economists insist that economic growth is necessary is that with our

present money rules, the system will break down if it doesn't grow.

Continual

exponential economic growth is required by the interest mechanism.

With a

properly designed money system, growth is not necessary.

Scarcity

Another

result of the operation of our money system is that even if all

traders try to manage their financial affairs carefully, in the long

term, some have to fail. In the loan process, remember, only the

principal was created as new money. No money was created with which

to pay interest. This leads to an underlying dynamic

of money scarcity in the productive trading community.

Scarcity

breaks down community by making a competitive atmosphere in which

everyone is competing to get scarce money to pay off their loans with

interest. In addition the control of money moves from the community

it serves to those who control its use, either by having a supply, or

by being in a position to control its creation. Scarcity,

and the resulting disparities in wealth and power between productive

traders and financial and money managers, are a result of interest

being a part of the rules of our present money system. They are not

a necessary fact of life.

Short

term thinking

In beginning Economics, students are taught about discounting

the future. The argument is as follows: Would I rather have $100

today, or a year from now? If I get the money now, I can either

spend it, or put it in the bank where it will draw interest without

risk. If put in the bank, at the end of a year, it will be worth

more than $100 by the interest rate, say 5%. So the $100 received a

year from now in this example will be worth only $95 since it didn't

get interest. Therefore it is better to get my money now, than in

the future.

What

is usually not inferred is that if money will be worth less in the

future, it is best to think short term. Any investment that doesn't

maintain its capital value and provide income greater than the

interest rate will have very little value when it does pay off,

because the same money could be multiplying without risk if just put

in the bank at interest. Thus, a major driver of

short term thinking in the corporate realm is the function of

interest in the money system.

Business

cycles

|

| Wikipedia List_of_recessions_in_the_United_States |

Interest is also the cause of business cycles; boom and bust. In

boom times, sufficient new money is created to keep up with the need

for growth in the money supply. However there comes a time when

growth outpaces demand, inventories expand, and banks decide not to

make as many loans. At this point, borrowers don't have sufficient

money to pay their existing loans to the banking system, and some are

forced into bankruptcy. This is the down side of the economic cycle.

While

the US dollar has been immune to breakdown during downturns because

of our position of having the dollar be the unit of account for

international transactions, numerous countries have seen their money

systems break down in the last 60 years as a result of the operation

of the current money system.(7) Business

cycles and potential system breakdown are artifacts of our particular

money rules. They are not necessary with a properly designed money

system.

Government

deficits

It is often thought that our Federal Government creates money. No.

If the government wants money, and decides it needs more than

Congress has decided to take in through taxes and fees, it borrows it

from the banking system, by selling bonds to the Central Bank to get

those funds, trading anticipated future tax income for money to use

now. In more simple terms, the government makes out an IOU, and the

central bankers – the house in the casino metaphor – use their

seigniorage to create money out of thin air to pay it. The cost to

the banks of these loans is minimal, and the return is guaranteed by

the government. This makes them into a cash cow for the central

bankers. Main street traders - us taxpayers - pay the interest on

these loans, for the right to have money for our government to spend.

A

complicating factor is that if the private sector doesn't borrow

enough money to maintain growth, as happens in the down side of the

economic cycle, the government has to become borrower of last resort,

and borrow money from the central bankers to put enough money into

circulation to keep up with the exponential need for new money so

that the system will not break down. Again the traders on Main

Street pay the interest on this money to keep the system afloat, and

to have money to trade with. To

expect the government to not run a deficit over the long term with

our money system is simply not an option.

The

combination of these practical structural problems is the basic

driver of our monetary cliff.

The

politician's and economist's advice in recent years for traders to

borrow and spend has been an attempt to put off government borrowing

and the day of reckoning when the system will break down. However we

are approaching a point where interest cannot be paid, and breakdown

is approaching. It would already have happened if China and other

countries had not bought our deficits. But breakdown will come, as

continued exponential growth is not feasible, and it is indeed the

monetary cliff that we are approaching.

Money

- the moral issues

Interest

and profit

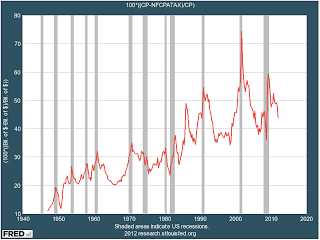

|

| Financial industry profits as % of the economy |

If we divide up - disaggregate in Economicspeak - the functions of

interest, we find that a portion of it is used to create and maintain

loans and cover risk. However a part of interest is profit –

effectively unearned income for the banking industry. The banker is

not doing work proportional to the interest charge. As noted

earlier, the result is phantom wealth, money gained without any

concrete service or product exchanged for payment.

In this case it is a tax levied on the borrower, payable to

the banking system,and paid by the banking system to its owners.

Ultimately it is a tax on the whole market, because the trader who is

the borrower has to cover this cost with their earnings.(8)

Especially in the case of larger loans a major portion of interest is

profit.

A

note here on profit as it is normally used is in order. Profit has

different functions in different cases. In a small business, it is

the income of the owner of the business, proportional to the risk

taken, and the work done. In larger businesses, it takes on a

different character. In larger businesses, at least a major portion

represents the value of work done by employees that is being

transferred to those who control the money of the operation. In the

banking industry it represents the portion of interest over and above

conservative costs of the services rendered.

Profit,

too, needs to be disaggregated to distinguish between these two

functions; productive earned income, and unearned income. This

brings us to consider the issue of transfer of income and phantom

wealth as a result of the structure and function of the money system.

It also brings us to ask how

much variation in income is appropriate in a democratic culture?

This is a moral discussion that must be opened if democracy is to be

a part of our future.

Interest

and structural violence

Our

money system

constitutes a form of structural violence.(9) Structural violence is

violence that has been integrated into the laws and habits of

society. Because it has been so integrated, it becomes so normal

that it is invisible in its action. The violence of our money lies

in the fact that phantom wealth is created by the effects of bank

seigniorage and interest in our current money accounting rules, and

that as a result, money is transferred from traders in the real Main

Street market to owners of the money/financial system.

As

noted, part of

interest paid goes for legitimate expenses in the operation of the

banking system. The rest is unearned income. To be blunt, unearned

income received by the financial industry from the operation of the

money system is functionally identical to the unearned income

received by welfare recipients. I know that bankers (and those who

live on interest payments) will rankle at being called welfare queens

(or kings), however the major difference between recipients of

unearned income and government welfare recipients is that the former

group has plush offices and homes, receives a much greater payment,

and perceive themselves to be respectable members of the community,

who have provided a real service, unlike their perception of

government welfare recipients. The problem is that in providing

their services, the financial industry, just like a casino, is

skimming/taxing the productivity of their clients, in this case the

whole economy.

What

we need to do at this point is consider what kind of welfare system

we want to have, and invent it deliberately, instead of living with

the inequitable extra-governmental welfare system we now have. This

will require rethinking our tax system (a tax system that has been

rigged by the financial system for its advantage) as well as major

changes in how our money works.

If

the payments that are currently transferred to the financial sector

as interest, over and above conservative reasonable costs of

recording and managing transactions, were reallocated to the people

who produced the goods and services that were traded for that money,

it would release an immense amount of energy and productivity in our

economy. It would also remove the scarcity element in our money

system, and begin to remove the greed motivation from the system

structure and allow other motivations, such as caring for our fellows

and our environment to blossom.

I

say begin, as there is another major cause that leads to scarcity and

greed. This is the fact that business corporations (including the

banks) have a pyramidal structure that is the same as a political

dictatorship/oligarchy. The leadership in this dictator/oligarchy

are welfare kings and queens in the same way that members of the

financial community are. Maintaining

a political democracy in the midst of economic dictatorships is a

recipe for loosing the democratic nature of the political democracy.

As money buys power in the halls of the political system, the

political system also takes on the attributes of dictatorship; the

dictatorship of those who control money. In the words of Benito

Mussolini, “Fascism should more appropriately be called Corporatism

because it is a merger of State and Corporate power”. (10)

Demurrage,

the Economicspeak term for negative interest, turns the problems of

interest on their head. When money loses its value over time, it is

in the interest of its trader/users to get rid of it, and instead

invest in something that will improve their lives over the long term.

More on demurrage later.

Trust,

leadership and power

As

noted earlier, accounting money rests on the trust of its users that

other traders will honor it, and that it's value will be stable over

time. So we have to think about the moral nature of trust, and what

kinds of institutions and structures are compatible with trust. This

brings us to a study of relationships and decision making. We need

to distinguish between two very different dynamics, which are

commonly characterized as 'power over' and 'power with'.

'Power over' relationships are characterized by coercion, by manipulation, or by

institutions that mandate that more power be given to one individual

or group than another. Institutional power, which often leads to

structural violence, is an especially insidious form of 'power over'.

Power over leads to fear, anger and greed.

'Power with' relationships are characterized by trust. No one

person in the relationship has a unique power position. The

interests of all are acknowledged and taken into account in any

decision. Sharing and caring also go along with trust.

'Power

over' is the current practice in almost all institutional

relationships. Even voting in representative democracies exhibits

the power of the majority, or other portion of a group necessary to

elect representatives or create policy or action.

'Power

with' is commonly practiced in informal relationships where equality

is valued, but it is found formally only in the deliberation of

juries, in internally consistent forms of the Sociocratic process,

(11) in institutions using effective consensus, the longest term

current example of which is the over 350-year decision-making

experience of The Religious Society of Friends (Quakers), and other

forms of coming to common judgment. It is usual to think that 'power

with' leads to anarchy on the larger group scale, however groups have

learned how to institutionalize this dynamic. Sociocracy

is the study of this technology.

An

institution based on 'power over' cannot in the long run operate on

trust. This can be seen in current monetary authorities'

uncontrolled actions in an attempt to maintain the operation of the

current system, protecting and bailing out the too big to fail banks

at taxpayer expense, in so doing violating the trust of money's

users.

What

I have argued may sound extreme, however it is the logical conclusion

that comes from the data. It doesn't lead to a dead end, either. It

simply tells us that we have to reorder the institutional structures

and relationships that we use in our economy. It will also make us

think twice about our political structures. In terms of money, it

leads us back to the simple money system that was described at the

beginning of this piece, and lets us start thinking about how to

organize the nuts and bolts of that system.

Who

really creates money?

Let's go

back. Remember the definition of money; an agreement to use an

accounting system to facilitate exchange? It is the trust of traders

and their resulting willingness to use the agreed upon money that

gives it its value, not the bank or financial manipulator. In our

economy, the banks and financiers have made it seem that they are the

necessary creators and managers of money. In fact, they only

mediate and control the process. It is the traders on Main Street

who have committed to producing value that guarantee the system.

This becomes

especially obvious viewing the savings and loan bailout, and the more

recent bank bailouts. If the central bankers (the house in the

casino metaphor) make loans or investments that aren't payable, they

claim they are too big to fail. They get bailed out. Their phantom

wealth gets preferred treatment over the real wealth that traders in

the market have earned.

*bailout And who

bails them out? Us taxpayers – the traders on Main Street.

Members of the financial system have made sure that they pay little

in taxes through their influence on the tax structure, their use of

off shore tax havens, and their preferred treatment under the law in

case of default. So it is ultimately the 99% Main Street traders

that guarantee the operation of the money system by our bailouts as

well as our faith and trust in the system.

The situation in

Europe is an example of where our banking system is headed. If the

banks get paid by the governments that owe them interest money, the

governments will fail. If the governments don't pay the banks, the

banks will fail. The phantom interest wealth created by the European

central bankers must be unwound, and to be just, not at the expense

of the traders who created real wealth for themselves and their

communities.

We are headed in the same direction here in the US. We have

a greater ratio of debt to Gross National Product than the poorer

nations in the European Union. As noted earlier, the only reason

that the US dollar has survived as long as it has is because it has

been used as the standard for international trade by all countries (aka global reserve currency).

That situation is rapidly changing. Just as the wars in Iraq and

Libya were about protecting the dollar and its banker owners as well

as about oil,(12) the present activity in Syria is related to Iran

and other nations that are not members of the Bank

of International Settlements

(BIS), and have their own independent currencies which can compete

with the dominant currencies of the casino owners.

And now China is

promoting the Yuan as a standard for foreign trade. The BRICS

countries Brazil, Russia, China and South Africa are negotiating to

create a development bank that will compete with the World Bank,

controlled by the US, British and European too big to fail bankers

that control the BIS. (13) We are not in a favorable position to

push back at China and its friends, as China holds a sizable amount

of our foreign debt, which they are now backing off on.(14)

The

present tack is to continue to pay off the central bankers, either

through taxing Main Street to pay the interest instead of providing

the normal services of the government, or by privatizing the commons

- government assets - giving them to the bankers instead of money

payment, as is being done in Greece and elsewhere. Either way Main

Street loses, and the central bankers win. The structure of the

system by its nature creates phantom wealth and in so doing

systematically moves real wealth from Main Street to the central

bankers.

The latest technique

of the BIS group, used as a test in Cypress, is to tax the holders of

savings accounts to cover the phantom claims of the central

bankers.(15) We have to expect that this is not the only example

planned for this way of dealing with the smaller banks and their

traders. The house of the casino will not easily give up its grip,

even attacking its contract table operators, as well as their Main

Street trader/depositors.

Questions

The

above analysis brings up questions that need thought and debate.

What changes in the money creation rules might make money consistent

with democratic and sustainable values?How can we move away from the monetary cliff?

More specifically:

- What institutional structures are consistent with promoting trust?

- In a democracy, is it appropriate for the money system, the basic mechanism for trade, to be a cash cow for a private group, or should the money system be a not-for-profit service for its users? Please note that the distinction is not whether money should be controlled by the government or private institution(s), but whether it is a not-for-profit, or for profit operation.

- Who should authorize the creation of money and receive Seigniorage, and for what kinds of products and services?

- Should money get worth more over time? Less over time? Simply maintain its value?

- How does our tax system relate to this issue. Is it appropriate for the government to use the tax system to represent us in supporting the welfare of our brothers? If so, at what level of government should this occur? What services are to be included in welfare?

- What should be our relationship with property, the earth and its natural resources?

- How should phantom wealth, which is not payable, be unwound?

Lessons

for action

Lessons we can learn

from this analysis are the following:

-

Ultimately borrowers (traders) are the functional creators of money, rather than the banking system, and ultimately the market is the guarantor of those funds, not the banks. Therefore the rightful holders of seigniorage, the collateral pledged for loans, and the decision makers concerning who should create money and receive loans, (the holders of seigniorage) are the members of the market, not the banking system.

- Money that has a negative interest rate – demurrage - creates the opposite of all of the effects of interest bearing money noted in the analysis above. It is better to get rid of demurrage based money and invest it in something that will lose less than the demurrage rate, maintain its value, or even gain in value over the long term, than hold on to the money and have it lose its value. As a result long term thinking and investing is reinforced.

- The cyclical effect of interest bearing money created by hoarding, resulting in money scarcity during economic downturns, and investing money, resulting in an overheated economy in boom times, are also stood on their head by the use of demurrage money, making money counter-cyclical.

- Local democratic control takes away the structural incentive for accumulation of centralized power.

Alternatives

The

problem at hand is succinctly described by Bernard Lietaer in the

following piece at one of his web sites.(16)

Aligning Moral and Economic Incentives

There are three main ways to induce non-spontaneous behavior

patterns: moral pressure, coercion, and economic incentives. For

example, recycling glass bottles can be promoted by education, by

regulations, or by incorporating a refundable deposit in the purchase

price. A combination of all three incentives is obviously the most

effective strategy.

When

these incentives conflict, problems will arise. For instance, when

there is an economic incentive to do something a regulation or law

prohibits, we need costly and permanent enforcement systems. Even in

the presence of such enforcement systems we expect . . imaginative

forms of cheating to occur. More evident are cases where moral

pressure is supposed to overrule economic interests. . . However,

this moral pressure is diametrically opposed to the concept of

receiving interest on money, which provides a built-in incentive to

hoard currency. Whenever there are such

structural contradictions many people are unable to afford, or simply

do not care enough, to follow the moral advice.

It

is possible, however, to design a coherent and operational currency

system so that this apparent structural contradiction disappears. In

other words, by questioning some traditional implicit assumptions, we

can realign the moral and economic incentives so that they are in

harmony. (Emphasis

added)

|

| ancient Egyptian grain receipt |

Lietaer gives examples of how money worked, and still works in a

number of settings.(17) An important example is ancient Egypt, where

there were two kinds of money. For exchanges outside the country,

precious metals were used. For internal exchange, grain was the

commodity that created the currency.

The system worked as

follows: The government had grain storage bins. If a farmer had

excess grain he took it to the government bin, and was given a

receipt, carved on a piece of soft fired clay, that gave the date and

amount of grain received. This clay receipt circulated as money.

Whoever came back to turn in the clay receipt for grain received

less, depending on the storage time. The time charge was used to pay

for the costs of storage. Unlike the Greek and Roman empires that

used interest bearing money, the Egyptian empire continued for more

than 2000 years, and ended only after the Romans took over and

introduced their currency.

We see here a

historical use of a demurrage currency, an idea reinvented by Silvio

Gesell about a hundred years ago.(18) As a side note, John Maynard

Keynes noted that Gesell had more of value to say about money than

Marx.(19) Keynes' proposal for a post WW II world monetary order

took advantage of a form of demurrage, but was sidelined by the

bankers of the winning countries.

|

| miser regrets demurrage |

To repeat,

money systems that utilize demurrage are counter cyclical. That is,

when they are employed, boom and bust business cycles are not

promoted. They also make a situation where traders have an incentive

to get rid of money, investing it in some long term project. The

incentive for short term profit is removed.

The issue at hand is

to design a kind of money that is stable over time, and is consistent

in its values with the values of trust, justice, democracy, and

sustainability/resilience. With design criteria in hand, we can

consider experiments to transition in that direction.

Suggestions

for possible characteristics of a sustainable monetary system

- Seigniorage in any new system needs to be vested in those that back the system with their commitment and trust; its users.

- Any new system needs to be prototyped on a small scale, and operated at a local level. Growth can occur by multiplication and connection, rather than by biggerization. This makes for a much more robust and less fragile money system, and one that is consistent with power with.

- Embodies mutual credit, rather than managed money creation. Remember, in a mutual credit system, money is created each time there is a financial transaction, with a debit entry in the buyer's account, and a credit in the seller's account. There is no need for central control of the money supply, as the money supply is self regulated by trades being made. Self regulation is much more immune to manipulation than central control, and automatically reflects the money supply needs of users. The money supply is free to increase or decrease according to need. Community members are much more effective in deciding what their needs are, and how to maintain solvency and economic balance than are profit oriented banks.

- Promotes maintenance of balances close to zero, not always keeping a positive balance. The principle of assuring that all budgets stay balanced (all account balances remain near zero, or return to zero) must be built into the structure of any monetary system, if it hopes to be stable over time.

http://www.openideo.com/open/vibrant-cities/concepting/debt-into-community-investment/ Locally based. Communities are like businesses, individuals, and national governments, in that they have to have balanced budgets in order to remain healthy. The disappearance of small towns in rural America is a good example of this issue. More money goes out of most small communities than comes in as a result of the siphoning of money to the banking system and outside corporations that supply inputs. This leads to their demise, and the sale of their assets to ever larger economic units. Local currency allows a community to measure and control its imports and exports and maintain its balance of payments.

- The same criterion of balancing payments needs to occur between community systems as well as within them. In other words, each community needs to maintain a balance of payments with other communities.

- Independent organization separate from government. Having an independent entity manage the money creation process puts the government business on an equal playing field with other businesses and individuals. It requires government, like any other business or person, to go to the community for authorization for deficit spending.

|

| http://www.thepolisblog.org/2010/02/participatory-budgeting.html |

- Democratically controlled, using a participatory budgeting process for large community improvements.(20) When a community using such a system sees that it would benefit from a project or purchase that would require a large sum of money, it can commit itself as a community to one or a group of its members, or its government, giving them a line of credit (permission to temporarily operate with a large negative balance) to complete a project or buy a product or service. This is what banks do now in making loans and governments do in issuing bonds. Under a democratic system, the decision making simply moves from the bank to the community, and there is no unearned income interest liability.

Larger

needs of individuals and groups can be dealt with in a similar manner

with general criteria for creditworthiness being used by the money

coordinators for larger yet routine transactions. Communities will

have to develop criteria for deciding to whom, in what amounts, and

for what kinds of projects to allow negative balances (loans). With

the need for profit removed, criteria centered on community needs can

define when money creation should occur.

- Non profit. So that money can be exclusively a service, it is imperative that the organizations that manage its creation are not-for-profit as well as democratic. When money creation becomes a for profit operation, it introduces the greed factor in its operation to maximize profit for its owners and operators. Profit becomes a driver for greed and concentration of wealth. This sets the tone for all transactions using it to do the same.

- Competitive. For non-profits, competition becomes a force to compete for quality of service. This makes competition a healthy factor in the economy, rather than a reinforcement of greed. Competition can be balanced with cooperation between groups and institutions to take on larger projects, for instance.

- Includes demurrage. It may be advantageous to have small fees on negative as well as positive balances. These fees can be created along with the principal as new money, taking away the need for growth that is created by interest in our present system. Demurrage removes the store of value criterion from the definition of money and prevents the drive to accumulate money. It forces traders to want to get rid of money and therefore speeds up the velocity of money transactions. It is counter cyclical in that it removes the motivation to hoard money when the economy slows down, which lowers the amount of money in circulation, limiting economic activity even further.

- Includes some mechanism for payment of expenses of money system operation. Transaction fees have been shown to slow down the rate of trading.(21) Demurrage can cover system operation. A monthly charge for banking services is another alternative, however it is a regressive tax, hitting small users harder than large ones, and does not give the positive benefits of demurrage.

- With money management firms being not-for-profits, any surpluses from the money operation are available to the community for distribution, making every member of the community a philanthropist. Everyone becomes involved in sharing.

- All bank balances are public record. The bank balance of anyone buying needs to be open knowledge to the seller, who can decide not to sell to someone who is not pulling their weight; buying more than they are selling (borrowing from the people with whom they trade by building up a large negative balance). As an alternative, with electronic payment systems, stops can be put on payments if balances get too negative, just as occurs now with credit cards. Transparency may be objectionable to Libertarians, however in the interest of trust, and trustworthiness, it is important.

- Money must have a value related to something. Commodity based money systems (such as that of ancient Egypt) have intrinsic value built into their commodity base, but have the limitation that the money outstanding is related to the supply of commodities, not the need for economic exchange. The natural base for money is the hour of work, as willingness to work and trade that work for the work of others is the basic engine of commerce.(22) The hour of work is therefore a natural measure of economic value, and one that is universal the world over. Its only limit in quantity is the time of its participants, which is the natural driver of economic exchange. Some small allowance may need to be made for undesirable, dangerous, or skilled work. The market will as a result be bound to the relative social value of labor for each product or service.

Jesus drives out the money changers Betting on the exchange value between different currencies for personal gain adds nothing of social value, is immoral and must be made illegal. It is for good reason that Jesus threw out the money changers and that for 18 centuries the Catholic Church decried the payment of interest. The Muslim faith still maintains this practice. Having all currencies based on the same criterion, an hour of work, simplifies transactions between communities and gives equal value to all people for their productive work. In so doing it obviates the need and utility of exchange rates, and the inequalities that they promote.

- There will be a need for regional, national and international clearing houses to manage transactions between communities. These clearing houses will also need to be not-for-profit operations. The use of the hour in all jurisdictions makes possible transactions between all systems at par.

- The proper role of government is to set the definition and operational rules of money, as it does now, through the Federal Reserve Act. The proper place for money creation is at the local community level instead of in a private for profit-bank board room or National Reserve Bank.

-

Until mutual trust in the larger system is established, it may be appropriate to use commodity based money for trade between communities which are not well known to each other.

- No part of the system should be allowed to grow to a point where it is considered too big to fail.

- We need to consider alterations in our tax system so that both its charges and payments support and promote trust, justice, democracy, and ecosystem health, both for the natural world and all of its people.

- Finally, we need to acknowledge that the earth's resources are a legacy that we all have an interest in, rather than commodities that accrue to the individuals or groups that can gain the rights to control and exploit them. This will require rethinking ownership and use patterns that have been accepted since the beginning of the industrial era. The place of the commons as well as both real and intellectual property in the economy will need to be looked at.

|

| Ludwig von Mises: kinds of money |

Some

groups, including the American

Monetary Institute,

propose that the Government put 'credit' money into circulation. It

needs to be understood that this kind of money doesn't come for free.

It is a one time tax on the market by the government

which issues it.

It is a loan to the government by the taxpayers, creating

seigniorage (a commitment) to provide services to the population. If

the money created is used for the general welfare, this may not be a

problem, however money so created can be used for corporate/imperial

projects as is being done by our current government.

An

additional disadvantage of such a system is that it perpetuates

central control and management of the money supply, rather than

having the money supply self regulate at the local level, as occurs

in a mutual credit system. On the other hand it may be appropriate

for governments to have banks to deal with catastrophic events, for

instance. In this case money creation can be seen as a commitment by

all of the citizens to help out those in need. Use of these banks

must be limited so that they are used only for the general welfare.

In order to maintain fiscal balance, these loans should be paid back

through taxes over time, not left in circulation as is proposed by

the American Monetary Institute and others, just as other loans are.

A

number of economists claim that it is possible to put any amount of

credit money into circulation without detriment to the economy. This

is not so. What is being done is diluting the currency, and creating

the money that is passed on as phantom wealth to the banking sector,

increasing the wealth divide.

Transition

It

is easy to say that the vision described here is all well and good,

but it is pie in the sky – not attainable from where we are now.

This brings up the issue of transition.

Transitioning to an economic system based on trust, sharing,

and community rather than greed, fear and anger will be filled with

problems. One of the most pernicious will be the resistance on the

part of those who benefit the most from the status quo to losing

their preferred status and power. Also knowledge of how things

currently work may make those who have been on the short end of the

stick very angry. We will have to relearn how to relate to each

other in institutional settings.

Those

who will lose power in the economic, military, and political spheres

need to look at the alternatives for their children and

grandchildren. Helping these people recognize the unsustainable

nature of the present money system can hopefully help convince them

that change is necessary, and that to bequeath the present system to

their children and grandchildren is to bequeath them chaos. Either

we can move toward a fair and just money and economic system, or we

will move toward economic and social breakdown and fascism.(23)

Everyone needs to recognize the basic humanity of everyone else, and

try to move creatively from where we are to a place that is resilient

and sustainable for us all. It will of necessity be a world without

war, and great differences in personal wealth. The commons may be

expanded, as the necessity for privatization of resources to

accommodate the need for growth in the money system is no longer an

issue. Property rights will likely be redefined.

A

second, related, cohort that will resist change is groups that are

accustomed to fatherly 'power over' leadership. This will equally

effect groups in the political, economic, religious, social and

family spheres. Groups that practice the fatherly mode of leadership

are accustomed to having the initiation of decision making be

concentrated in the father/leader, and the leaders often expect that

those who relate to them trust them and agree with and follow their

suggested proposals. If a proposal enacted by the leader is not in

the best interest of those affected by it, or favors the leader, we

are observing another case of structural violence, where a leader

expects to be the decider for the group. This will be an especially

difficult dynamic to change, as both leaders and followers are

accustomed to this way of operating. This dynamic can be especially

pernicious in religious groups, where the leader claims moral

leadership. In this context it must be seen that the raising of

children is the process of leading a child from dependence, through

independence to interdependence. Adults who relate interdependently

relate in 'power with' mode.

Another

cohort that will be resistant is that group of middle and upper class

people who have made investments and are expecting to have this money

for income for their retirement, and for passing on to their

descendants. Fear of not having this income, and justification of

the system that they used to get their nest egg makes them resistant

to change. Mechanisms to deal with this issue will have to be worked

into any transition proposal. Treatment of earned income saved will

be different than income from interest and other unearned income.

Proposals for those who have just accumulated funds necessary for

their retirement can and should differ from proposals for those who

can never reasonably spend themselves what they have accumulated.

This is the way that we will unwind the phantom wealth that has

accumulated. While plans to deal with personal accumulation of

wealth must meet the value criteria of the new economy, they must

also respect those who have gained from the present system. These

people are human too, even though they have been involved in the

structural violence of the present system. On the other hand, they

will have to give up their excessive power and become equals with the

rest of us.

As

we remove the possibility of building a nest egg with interest on

money, we have to develop new ways to invest, and to support those

who need support, that build our communities and ecosystems, rather

than destroying them. With a money system that includes demurrage,

such investments won't be fighting the short term profit motive and

the growth imperative that are major motivators in the present

negative sum money economy. To the extent possible, decisions on

such issues as this should be made at the local level. However in

the interest of justice, some rules and regulations are appropriate

at higher levels. As noted earlier, the tax structure will also of

necessity be involved in this evolution.

Society

has many issues that have not been dealt with well in the present

economy based on greed and power over. Freeing the economy from the

necessity for greed and the resulting war economy will open many new

possibilities for curiosity, caring and sharing – with our fellow

humans, toward our earth and its many forms of life, and toward the

cosmos. The greening of the earth will become a natural outcome, as

respect for people and the earth become major motivators.

There

will definitely need to be programs for retraining those whose

industries are phased out. A guaranteed income utilizing the

dividend currently being paid as interest is one mechanism to help

smooth the transition. Reallocation of funds currently spent on war

is also a major potential source of money for social programs.

The

obstacles to transition are high, but the stakes are immense. The

questions before us are do we want to follow the model of the Roman

empire which led to the dark ages, or do we want to transition to a

society and economy that is resilient and sustainable, and are we

willing to do what it takes to get to an economy that respects

everyone – each with their own cares and gifts to share?

Appendix

A

Margaret

Mansfield describes structural violence as follows: “Structural

violence occurs when physical and psychic harm results from systemic

policies that don't directly rely on overt force”.(24)

Mansfield

lists four characteristics of this form of violence:

- Structural violence is hard to recognize. It is embedded in institutions that are considered normal.

- Structural violence is short sighted. It damages everyone, slave holder as well as slave.

- Structural violence is self reinforcing. It creates vicious cycles such as the cycle of ever increasing disparity of poverty of the many and affluence of the few.

- Structural violence promotes scapegoating. Labeling, from “welfare queens” to “corporate fat cats” deflects attention away from policy and its administration.

(The

author recognizes that he has engaged in the fourth activity in this

paper. It was felt that to name the problem, noting that corporate

fat cats and welfare queens are one and the same, was of greater

importance than the possibility of labeling taking away from

continued discussion.)

Notes

1

Even coins have little intrinsic value. Historically, if the value of

coins became as great or greater than their value as coins,

they were melted down by their users and sold as raw metal, as that

has greater value to the holder.

2

This is a simplification of the actual system which is documented by

Bernard Lietaer in New Money For a New World, Quiterra Press,

2012, pp 32-34. However the simplification above is the result of the

actual more complicated system.

3

David Korten, Agenda for a New Economy, Barrett-Koehler, 2010,

http://livingeconomiesforum.org/

4

The results are documented in Sleepwalking to Extinction at

https://www.adbusters.org/magazine/110/sleepwalkingextinction.html

5

At this time in history, Jews were not allowed to own land so they

entered skilled trades for income. A few became goldsmiths, and

became the first bankers. The families of these goldsmith/bankers are

still central to the banking system. This is the basis of at least

some of the antisemitism we see today, all Jews being blamed for the

power gained by a very few of their number as bankers.

6

See http://www.theforensicexaminer.com/archive/spring08/13/

and http://en.wikipedia.org/wiki/Tally_stick

7 http://wwwwds.worldbank.org/external/default/WDSContentServer/IW3P/IB/1996/07/01/000009265_3961214130910/Rendered/PDF/multi_page.pdf

8

Bank fees are also becoming an important income stream in the banking

industry. While they are justified as covering expenses of the bank

they also, when disaggregated, have a significant unearned income

component.

9

See Appendix A

10

Quoted from

http://www.goodreads.com/author/quotes/221166.Benito_Mussolini

11

See http://en.wikipedia.org/wiki/Sociocracy,

For internal consistency, contrast the work of Kees Boeke,

worldteacher.faithweb.com/sociocracy.htm,

who saw Sociocracy as a group of interacting individuals, with power

equally distributed, with that of John Buck and Gerard Endenburg

http://www.governancealive.com/wpcontent/

uploads/2009/12/CreativeForces_9-2012_web.pdf

where triangles are arranged in a pyramid with the group at

the top in a special position of power. This hybrid nature follows

from attempting to get the advantages of group participation without

money giving up its veto power.

12

http://www.washingtonsblog.com/2012/01/are-the-middle-east-wars-really-about-forcing-the-world-into-dollars-andprivate-central-banking.html

is a review article relating documentation and research on

money and Middle East policy.

13

http://rt.com/business/russia-brics-bank-g20-468/

and

http://www.moneycontrol.com/news/current-affairs/settingupbrics-development-bankthe-pipeline-pm_994558.html

14

http://www.bloomberg.com/news/2013-11-20/pboc-says-no-longer-in-china-s-favor-to-boost-record-reserves.html

15

http://www.infowars.com/robbery-of-cyprus-bank-accounts-doubles-in-size/

16

http://www.transaction.net/money/cc/cc01.html#align

17

http://www.transaction.net/money/cc/cc04.html#history

18

http://www.appropriate-economics.org/ebooks/neo/gesell.htmbook

19

John Maynard Keynes, General Theory of Employment, Money and

Interest, Book VI, Chapter 23, text available at

http://userpage.fu-berlin.de/~roehrigw/keynes/engl.htm

20

See www.participatorybudgeting.org

21

Irving Fisher, Stamp Scrip, Adelphi, New York,1933

22

Robert Blain, Toward World Cooperative Community, With a Proposal

for a World Monetary System, Southern Illinois University at

Edwardsville, Edwardsville, IL, 1979, out of print

23

https://www.adbusters.org/magazine/110/sleepwalking-extinction.html

24

Mansfield, Margaret, “Structural

Violence and Friends Testimonies: Simplicity is not Enough,”

in Seeds of Violence, Seeds of Hope.

Friends Testimonies and Economics, 14 New Jersey Ave, Hainsport NJ,

ca 2005.

http://www.quakerearthcare.org/article/seeds-violence-seeds-hope

Further

Resources

What

is said here only scratches the surface of what needs to be done.

Many organizations and people are already out there working on the

transition. A few resources that come to mind (in no particular

order of importance, just the order that I thought of them):

- The Natural Economic Order by Silvio Gesell at http://www.utopie.it/pubblicazioni/gesell.htm

- Transition towns http://www.transitionus.org/ http://www.transitiontowntotnes.org/

- Participatory budgeting www.participatorybudgeting.org

- Sociocracy overview http://en.wikipedia.org/wiki/Sociocracy

- Bernard Lietaer The Future of Money, Random House, London, 2001, Different ways to organize money at www.transaction.net, www.lietaer.com, http://www.terratrc.org/PDF/Terra_WhitePaper_2.27.04.pdf,

- Margrit Kennedy http://www.margritkennedy.de/index.php?lang=EN

- Edgar Cahn and Jonathan Rowe, Time Dollars, Rodale Press, Emmaus, PAhttp://www.timebanks.org/

- David Korten, Agenda for a New Economy, Barrett-Koehler, 2010,http://livingeconomiesforum.org/

- Robert Blain Hour money http://www.hourmoney.org/ Blain has developed a board game called Cooperation that allows users to experiment and experience the results of different ways of organizing money

- MetaCurrency Project http://www.metacurrency.org/ building new structures for money, especially for computer geeks and coders but of relevance to all.

- Brian Milani http://www.greeneconomics.net/

- Yes Magazine www.yesmagazine.org/

- the Green Party www.gp.org/

- Ron Paul - Campaign for Liberty http://www.campaignforliberty.com/ (With the caveat that Libertarians focus on rights, while ignoring the responsibility toward one's fellows and the earth that comes in a democracy with freedom.)

- Many single issue groups and organizations

- A number of web based news organizations that publish news that is not carried by the major networks.

Add your own favorites to this list

Caveat

As

author of this piece, I must acknowledge that I benefit from this

system, as well as paying into it, though I have paid in more than I

have received. This

study is a work in progress. Comments are welcome. The author can

be reached at pkrumm@gyldwynds.info

No comments:

Post a Comment